Smarter Web Company Doubles Down on Bitcoin Treasury Strategy

The Bristol-based tech firm reaffirmed its long-term commitment to Bitcoin through its “10-Year Plan”, which focuses on converting treasury assets into BTC while leveraging capital markets for expansion when conditions align.

“We believe Bitcoin is the best asset the world has ever seen,”said Andrew Webley, CEO of Smarter Web Company.“As a public company, we can use capital markets to strengthen our balance sheet by accumulating Bitcoin.”

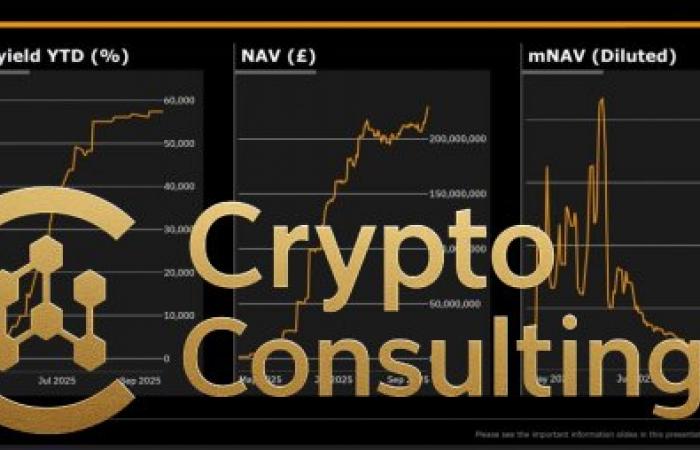

The company has reported impressive results so far in 2025 — achieving a 57,718% BTC yield and 50% growth in net asset value.

Exploring Distressed Acquisitions for Bitcoin Discounts

Despite recent valuation fluctuations, Smarter Web Company’s market capitalization briefly surpassed £1 billion during the summer and remains up 150% year-to-date, outperforming nearly every other firm in the FTSE 350.

Following a Proven Bitcoin Treasury Playbook

According to Bitcoin Treasuries, Smarter Web Company now ranks 30th globally among public BTC treasury holders, ahead of American Bitcoin Corp, Microcloud Hologram, and HIVE Digital Technologies.

Within the UK, it remains the top Bitcoin treasury firm, followed by Satsuma Technology Plc, which holds roughly 1,140 BTC worth around $130 million.

Industry leaders believe this trajectory could make Smarter Web Company the dominant Bitcoin treasury player in the UK.

“There will be a dominant Bitcoin treasury company in every capital market,”said David Bailey, CEO of Bitcoin Magazine.

Traditional Investment Platforms Remain Skeptical

However, after the UK Financial Conduct Authority (FCA) lifted its ban on crypto exchange-traded products, the platform plans to allow “appropriate clients” to trade crypto ETNs starting in early 2026.

Final Thoughts