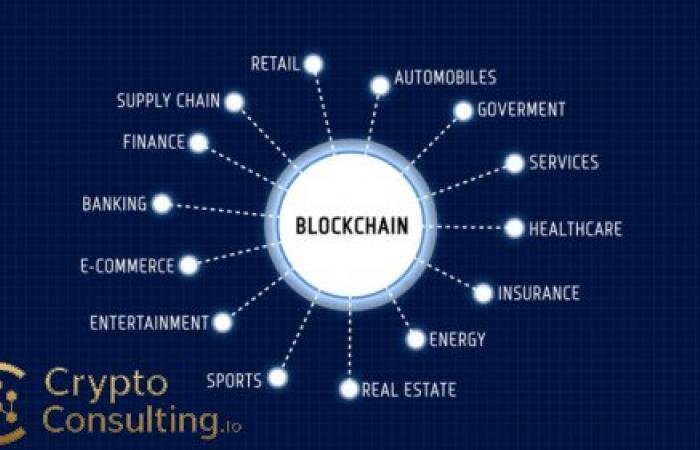

Blockchain, once heralded as the backbone of cryptocurrencies, has entered a new phase in 2025: one where it moves decisively from speculative promise to foundational infrastructure. The ledger concept that underpins blockchain — a decentralised, tamper-resistant record of transactions — is no longer just about coins and tokens; it’s reshaping how industries think about identity, assets, governance and automation.

From Crypto Playground to Real-World Backbone

Initially, blockchain’s greatest appeal was its use in trading and token creation. But today the focus has shifted. Financial institutions are exploring decentralised tokens and cross-border payments. Supply-chain actors are leveraging immutable ledgers to fight fraud and improve transparency. Identity systems are being redesigned so that individuals, not intermediaries, can control their credentials. These shifts reflect a broader maturation of the technology and a recognition of its enterprise value.

What’s Driving the 2025 Inflection?

Several factors converge to make 2025 a key year:

-

AI + Blockchain Convergence: Artificial intelligence is increasingly being paired with blockchain so that automated agents operate on verified data, smart-contracts execute more complex logic, and decentralised applications become more intelligent.

-

Sustainability Push: Energy-intensive consensus models are being replaced by eco-friendly alternatives, which helps assuage environmental concerns and open the door for wider institutional adoption.

-

Tokenisation of Real-World Assets (RWA): Assets such as real estate, commodities and intellectual property are increasingly represented as digital tokens, offering fractional ownership, higher liquidity and global access.

-

Interoperability & Layer Architecture: More networks are adopting scalable layer-2 and layer-3 structures, and cross-chain protocols are enabling different blockchains to communicate seamlessly.

-

Regulatory and Institutional Momentum: As frameworks for digital-asset oversight become clearer, larger players feel more comfortable integrating blockchain into their operations.

Key Areas to Watch

-

Decentralised Identity (DID): With data privacy increasingly under pressure, blockchain-based identity systems that let users control access, verification and sharing are gaining traction.

-

Real-World Infrastructure on Chain (DePIN): Decentralised physical infrastructure networks—such as storage, bandwidth and computing resources—are being tokenised and rewarded via blockchain.

-

Bridging TradFi and Web3: Traditional finance and legacy institutions are no longer ignoring blockchain; instead, they’re building or partnering to deploy shared ledgers that compete with their own older systems.

Risks and Considerations

Despite the momentum, challenges remain. Scaling remains a tech bottleneck for many networks. Governance models for decentralised systems are evolving but still untested in critical scenarios. Security and auditability — especially for smart contracts and interoperability bridges — remain failure points. Moreover, regulatory divergence across regions can slow global deployments.

The Takeaway

Blockchain in 2025 is less about speculative coins and more about durable infrastructure. For investors, technologists, and decision-makers in crypto and beyond, the message is this: focus on adoption, utility, security and integration rather than hype. The networks that deliver real value—through assets, identity, infrastructure and governance—will define the next phase of digital transformation.

Suggested SEO Keywords

blockchain 2025 trends, tokenisation real-world assets blockchain, AI blockchain integration, decentralised identity blockchain, layer-2 layer-3 blockchain scalability